How Mid-Market Banks Are Unlocking Value in ANZ’s Consolidating Tech and Tech Services Landscape

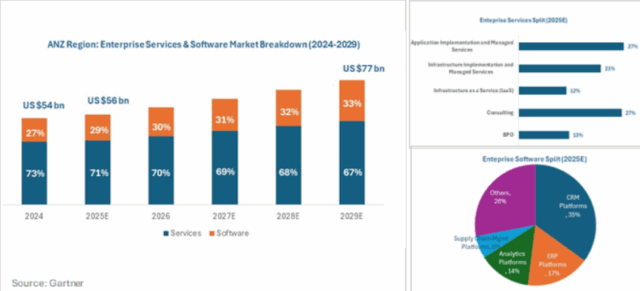

The Australia-New Zealand region continues to stand out for its technology-driven growth and M&A momentum. In 2024, the ANZ enterprise services, and software market reached US $54 bn (Enterprise Services: US $39 bn, Enterprise Software: US $14 bn). By 2025, it is projected to hit US $56 bn, powered by US $40 bn in services and US $16 bn in enterprise software.

Within services, consulting (27%), application implementation/managed services (27%), infrastructure services (21%), BPO (13%), and IaaS (12%) are leading growth. On the software side, customer experience and CRM (35%), ERP (17%), and analytics platforms (14%) are the top categories.

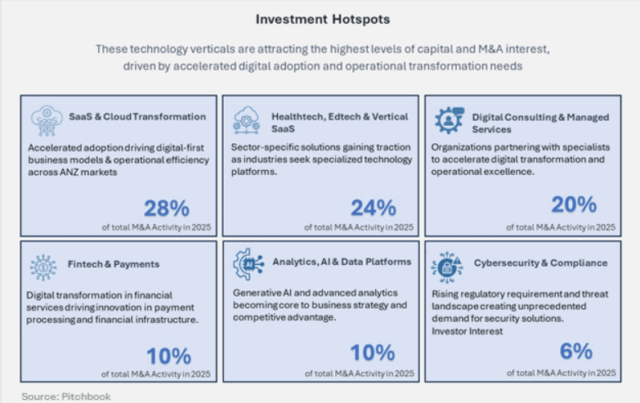

Where Investors Are Looking

After a cautious period over the last 12-18 months, investor confidence is rebounding across the ANZ region, with a wave of deals focused on digital transformation and operational resilience. The accelerated adoption of SaaS, cloud transformation, generative AI, automation, cybersecurity, and advanced analytics has made these verticals magnets for capital and M&A interest. In today’s environment, businesses are doubling down on productivity, back-office simplification, customer experience, and data-driven innovation. These themes are defining the new mid-market growth story in ANZ.

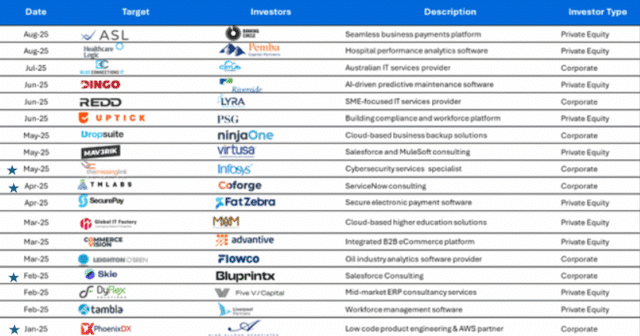

Mid-Market Tech & Tech Services M&A: 2025 Deal Highlights

A surge in mid-market tech and tech services M&A in 2025 spans cloud software, consulting, IT services, payments, analytics, and digital infrastructure. This trend showcases the strong appetite of both international and local buyers for ANZ’s technology leaders and service providers. Here is a select list of recent mid-market transactions: Advised by TH Global Capital

Source: Pitchbook

As the industry continues to consolidate, mid-market banks play a pivotal role in surfacing value, orchestrating cross-border M&A, and forging long-term growth paths for founders, investors, and strategic acquirers.

How Mid-Market Banks Unlock Outsize Value for Tech Companies

During periods of consolidation, mid-market investment banks help founders and investors unlock premium valuations. Here’s how:

For founders and sponsors, a strategic advisor can significantly enhance exit outcomes.

TH Global Capital combines deep sector expertise with a global network to guide founders, investors, and companies through mergers, acquisitions, and growth strategies. With a long history of advising technology and services businesses, the firm brings hands-on experience and practical insights to every engagement. For further insights or to explore how TH Global Capital can support your next move, reach out for a confidential conversation.