As digitization and compliance demands accelerate, financial institutions are entering a period of rapid change across e-signatures, KYC, onboarding, loan processing, and compliance platforms. Strategic acquirers, private equity firms, and global investors are actively reshaping the landscape. At the same time, AI-powered advances such as document automation and intelligent, reusable trust frameworks are setting new standards for both regulatory compliance and customer experience.

Latest Trends: From Compliance Burden to Customer Delight

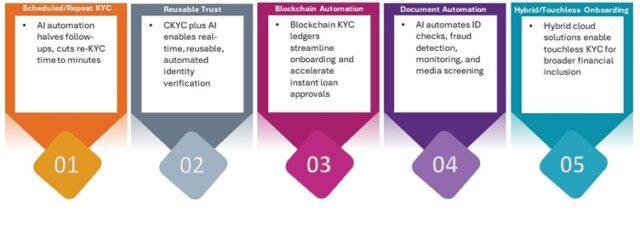

CKYC & AI Are Transforming the Rules: Traditionally, KYC meant friction and box-ticking. But thanks to Central KYC (CKYC) and next-gen AI, banks and Fintech’s are shifting from a compliance-first to a customer-delight-first approach.

The Real Payoff: Institutions are witnessing 70%+ faster approvals, slashed compliance costs, and sharp reductions in fraud and manual error, while customers enjoy instant, seamless onboarding and servicing.

M&A Trends: The Numbers Tell the Story

Strategic Investors and PE Deals by Half-Year

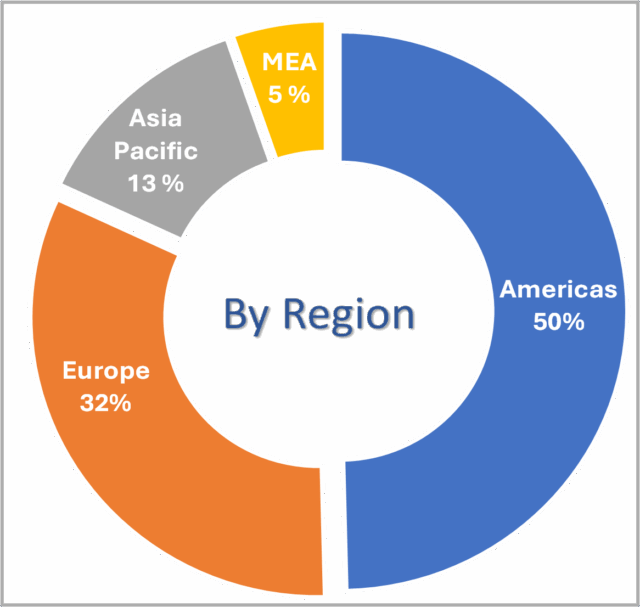

M&A by Region (2024-YTD2025)

Source: Pitchbook

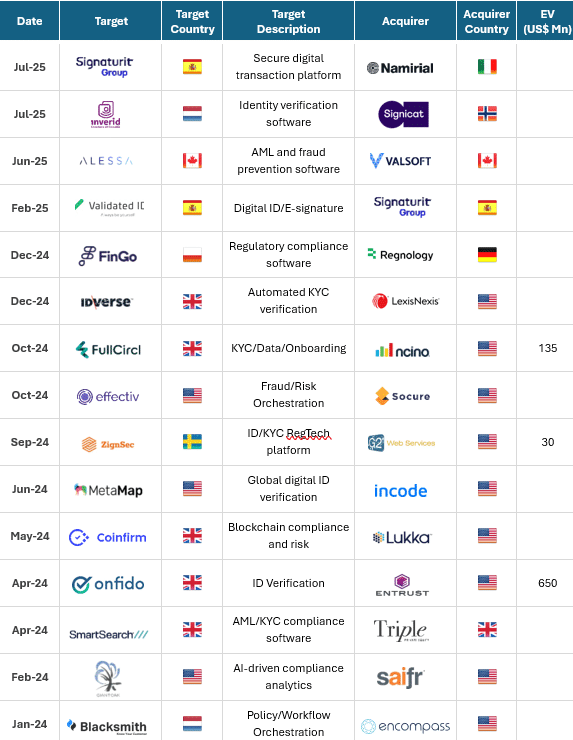

The exclusive merger negotiations between Namirial and Signaturit—both leading European providers of Digital Transaction Management (DTM) solutions backed by Bain Capital and PSG Equity are a clear demonstration of consolidation accelerating in the sector.

Activity is up sharply in 2025. Strategic investors, listed and PE-backed, are leading the charge, with PE consolidation expected to become more prevalent, given the still relative fragmentation across countries. A good example of European cross-country consolidation is the recently announced acquisition of Spanish Signaturit, backed by PSG, by Italian Namirial, backed by Ambienta and Bain Capital.

Other recent deals underscore how top providers are acquiring for next-generation AI. In April 2024, Entrust acquired Onfido to embed AI-driven biometric and document verification into its global identity platform. Likewise, Saifr (a Fidelity company) acquired Giant Oak’s GOST for advanced AI-powered adverse media screening and continuous KYC monitoring. Setting a strong precedent in the UK, nCino acquired FullCircl for US $135 mn, enhancing its banking cloud with smart data-driven onboarding and client lifecycle management. In the digital identity space, Signaturit acquired Validated ID, bringing VIDwallet’s biometrics and mobile identity innovation into Europe’s leading e-signature and digital ID portfolio, expected to reach €70m annual recurring revenue post-transaction. These moves highlight the industry’s shift toward holistic, automated compliance and digital trust solutions, setting a new standard for the sector.

Drivers Behind the Consolidation Wave

- Platformization: Buyers aim to own every step, creating unified, end-to-end platforms from onboarding to AML, powered by advanced AI and reusable trust layers

- Compliance-first Mindset: eIDAS 2.0 (EU wide digital ID framework), RBI reforms, and global AML rules are forcing convergence towards platforms that assure cross-border compliance

- From Country Specific to Pan European: Most European KYC providers were country-specific, but eIDAS 2.0 enables cross-border digital IDs, paving the way for pan-European platforms

- AI-Powered Differentiation: Acquirers seek capabilities in facial biometrics, fraud monitoring, and smart data orchestration

- Premium Tech and Traction: Strong ”stickiness” / retention metrics with enterprise clients naturally command higher deal multiples

- Speed to Scale: Consolidation delivers access to new markets, data pools, and regulatory credentials in a fraction of the organic time

Notable Recent M&A Transactions (2024-25)

Conclusion

The trust and compliance landscape are being redrawn by two mega-trends: AI-driven transformation (faster, smarter, reusable and reusable KYC) and industry consolidation (into global, AI-native platforms). Strategic acquirers and private equity are rewarding those who combine auditable, explainable AI with seamless customer journeys and regulatory readiness. Institutions unwilling to evolve will be left behind as buyers seek full-stack, compliance-ready, data-driven franchises that scale

TH Global Capital supports ambitious fintech, regtech, and financial services software leaders helping position AI-powered, trusted platforms for strategic M&A and growth investment. Connect with us if you would like to discuss how these trends may help you execute your vision.