In the global digital economy, Business Process Management (BPM) has always been an essential, behind-the-scenes value generator. While the sector rarely grabs headlines like Big Tech or SaaS disruptors, it quietly powers transformation in banking, telecom, health, retail, and nearly every major vertical. Today, as automation, AI, and digital customer experience (CX) become non-negotiable for business competitiveness, BPM’s relevance is entering a new phase, a one that investors, founders, and strategics can no longer afford to underestimate.

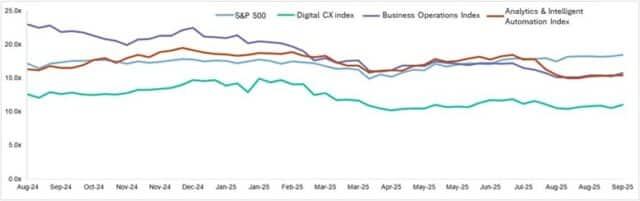

A Sector with Strong Fundamentals, Discounted EBITDA Multiples Compared to S&P 500

Despite delivering reliable revenue growth, high profitability, and strong client retention, the BPM sector is still valued at a discount. Looking at average EBITDA multiples shows how wide the gap remains

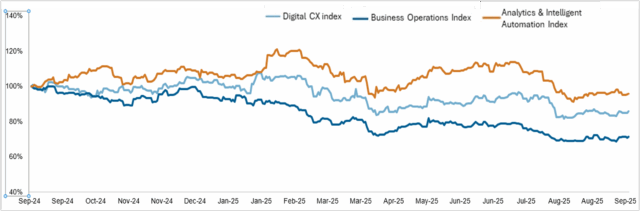

Interestingly, these BPM models are not only resilient but also often provide more recurring and cash-generative results than many widely discussed tech services sectors. Even with these strengths, share prices for Digital Customer Experience Index and Business Operations Index companies declined by 20% and 10% respectively over the last year. In contrast, analytics stocks remained flat. This disconnect highlights a significant opportunity for investors who look past outdated stereotypes and focus on the sector’s strong fundamentals.

Interestingly, these BPM models are not only resilient but also often provide more recurring and cash-generative results than many widely discussed tech services sectors. Even with these strengths, share prices for Digital Customer Experience Index and Business Operations Index companies declined by 20% and 10% respectively over the last year. In contrast, analytics stocks remained flat. This disconnect highlights a significant opportunity for investors who look past outdated stereotypes and focus on the sector’s strong fundamentals.

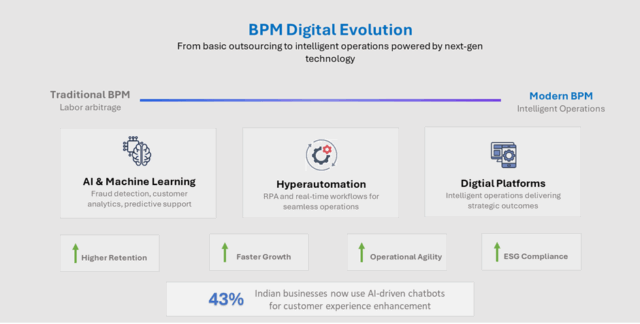

BPM Is Not Standing Still: Digital Transformation Shifts the Narrative

Globally, BPM sector is in for a dramatic pivot, with leading providers investing in digital technologies to reshape operational and customer experience standards

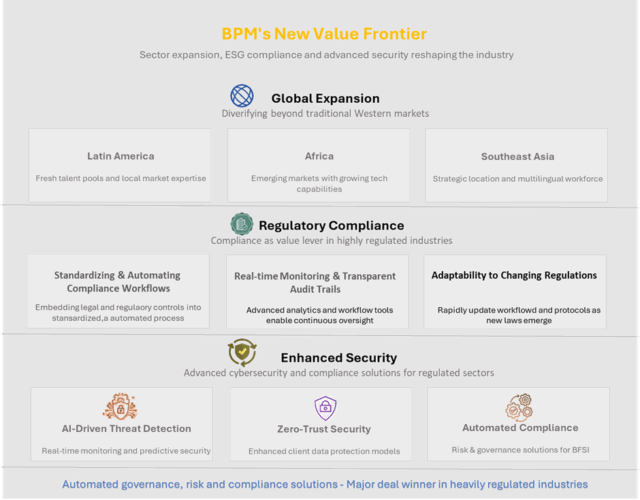

Global Expansion, Compliance, and Enhanced Security: A New Value Proposition

The Numbers Tell the Story: M&A Activity and Capital Flows

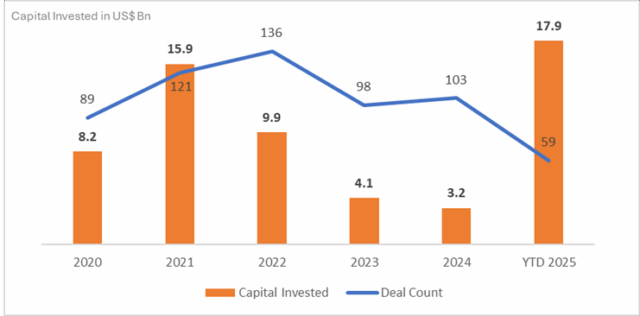

Investment trends show a sector in accelerated transition. Our deal flow data highlights this:

Source: Pitchbook

Importantly, while the number of deals was relatively flat, capital invested has sharply rebounded in 2025, signalling larger, platform-scale transactions and renewed confidence from both strategics and private equity investors.

Why the Valuation Discount Exists—and Why It May Not Last

Low EBITDA multiples in the BPM sector have not been consistent over time. They declined noticeably after COVID-19, coinciding with rapid GenAI adoption, intensifying competition, technological shifts, and cautious investor sentiment about sustainable differentiation. However, as the BPM market increases from US $173 billion in 20252 to nearly US $207 billion by 20292 at a projected 4.1% CAGR2, and as intelligent automation becomes more integral, it appears likely that valuations will eventually align with underlying fundamentals.

While the broader BPM market is seeing a steady single digit growth each year, more dynamic segments are leading the way. Digital Customer Experience (CX) services are projected to expand at a robust 15.8% CAGR3, while AI and Analytics services are expected to grow even faster at 22.6%3 over the same period. Furthermore, BPMs with specialized, domain expertise in regulated sectors—such as BFSI, healthcare, and logistics—are outpacing generalist peers, using their compliance capabilities and sector-specific solutions to drive greater value and differentiation. Strategic buyers and investors are increasingly focusing on these high-growth, domain-focused BPM companies, which are now beginning to command premium valuations and stand out within a rapidly evolving market.

As the broader sector pivots and delivers on the promise of business transformation, the public markets are likely to take notice. Capgemini’s US $3.3 bn acquisition of WNS at $76.50 per share in 2025 highlights rising strategic premiums for digital-led, high-margin BPM leaders.

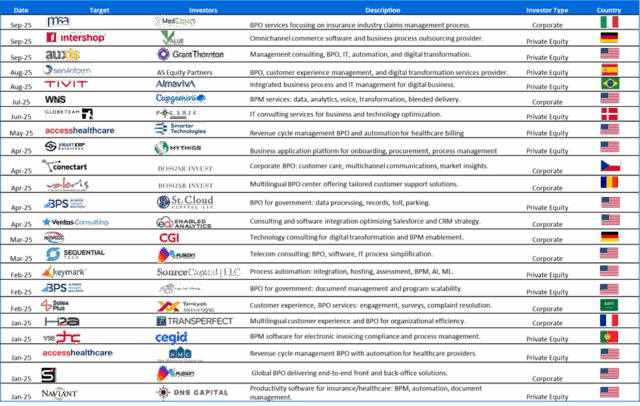

Recent Landmark Deals in BPM, KPO & Analytics:

The recent wave of BPM, KPO, and analytics transactions reflects accelerating industry consolidation. Deals like Capgemini’s acquisition of WNS and Fusion CX’s buys of Sequential Technology and S4 Communications demonstrate how market leaders are scaling, deepening their tech and CX capabilities, expanding global reach, and driving transformation through strategic combinations. Here is select list of BPM recent BPM transactions

Conclusion:

BPM is no longer just “front office or back office.” The sector has become a driving force for digital transformation, customer engagement, and operational resilience, as intelligence and automation reshape client expectations across industries. Importantly, the sector’s shift is drawing sustained private equity interest, with sponsors targeting scalable platforms and next-generation service providers to capture value from digital CX, advanced analytics, and domain-focused solutions. As valuations remain attractive and consolidation accelerates, ignoring BPM now could mean missing out on one of the decade’s most compelling growth and investment stories.

TH Global Capital stands out with a specialist deal team dedicated to BPM, customer experience, analytics, and AI. Operating across 15 countries, the firm brings deep sector expertise, a global buyer network, and hands-on transactional support to drive premium outcomes for clients in these fast-evolving markets.

Connect with us for a deeper discussion on sector strategy, deal environment and to explore strategic options including selling or acquiring businesses in these spaces.

1: Global Enterprise Services Market Size Forecast

2: Gartner Enterprise Services Forecast Q2 2025

3: Customer Experience Management Market Size, Grand View Research

Digital Customer Experience Index: Teleperformance, Concentrix, TTEC Holdings, Wipro

Business Operations Index: WNS, Genpact, EXL Service, HGS, Firstsource Solutions, Infosys BPM, TCS

Analytics & Intelligent Automation Index: Cognizant Technology Solutions, Accenture, IBM, Tech Mahindra, Xchanging